Mortgage rates have slowed buyers down this year. If you’ve been thinking about buying a home, mortgage rates are probably top of mind for you. They may even be why you’ve put your plans on hold for now. When rates climbed near 8% last year, some buyers found the numbers just didn’t make sense for their budget anymore. Others shifted to less expensive homes such as condos or townhomes in the suburbs. That may be the case for you too.

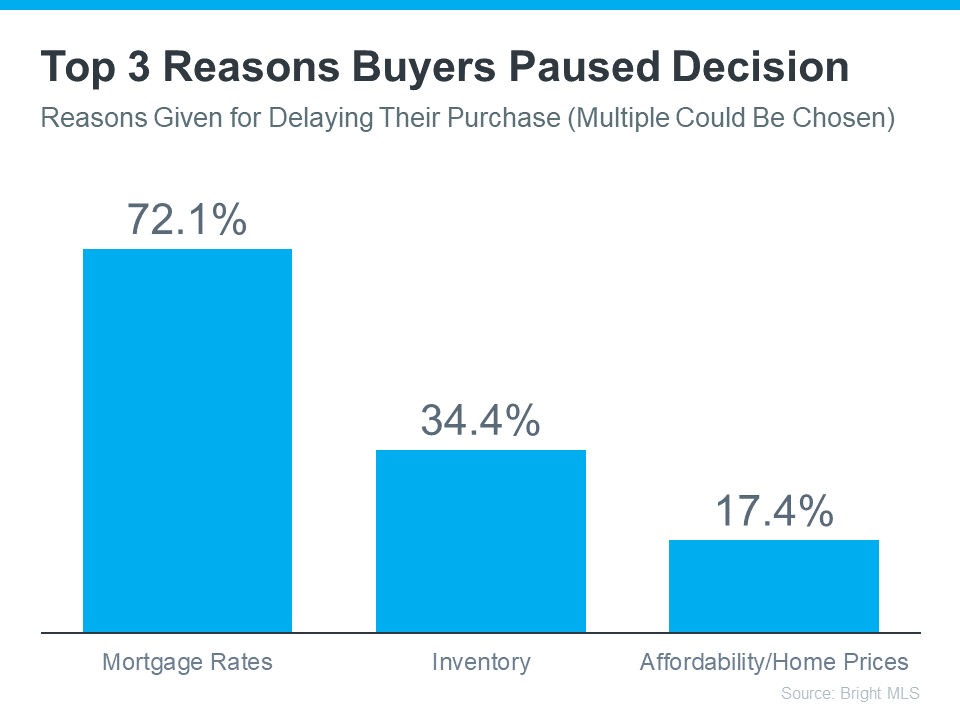

In the dynamic landscape of personal finance, interest rates wield significant influence over consumer behavior, particularly in the realm of big-ticket purchases like homes, cars, and investments. Data from Bright MLS shows the top reason buyers delayed their plans to move is due to high mortgage rates (see graph below): While interest rates are a crucial component of economic policy, their fluctuation can create both opportunities and challenges for buyers. High interest rates can significantly reduce the purchasing power of buyers. When interest rates rise, the cost of borrowing increases, leading to higher monthly payments for mortgages. This decrease in affordability can deter prospective buyers from making home buying decisons where mortgage rates heavily influence housing affordability. As a result, high mortgage rates have slowed buyers. Demand is constrained and economic activity in sectors such as home buying which are reliant on consumer spending.

Top 3 Reasons Buyers Paused Purchases

David Childers, CEO at Keeping Current Matters, speaks to this statistic in the recent How’s The Market podcast:

“Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”

Reasons for Optimism in Rate Projections

That’s because mortgage rates have come down off their peak last October. And while there’s still day-to-day volatility in rates, the longer-term projections show rates should continue to drop this year, as long as inflation gets under control. Experts even say we could see rates below 6% by the end of 2024. And that threshold would be a gamechanger for a lot of buyers. As a recent article from Realtor.com says:

“Buying a home is still desired and sought after, but many people are looking for mortgage rates to come down in order to achieve it. Four out of 10 Americans looking to buy a home in the next 12 months would consider it possible if rates drop below 6%.”

While mortgage rates are nearly impossible to forecast, the optimism from the experts should give you insight into what’s ahead. If your plans were delayed, there’s light at the end of the tunnel again. That means it may be time to start thinking about your move. The best question you can ask yourself right now, is this:

What number do I want to see rates hit before I’m ready to move?

The exact percentage where you feel comfortable kicking off your search again is personal. Maybe it’s 6.5%. Maybe it’s 6.25%. Or maybe it’s once they drop below 6%.

Once you have that number in mind, here’s what you do. Connect with a local real estate professional. They’ll help you stay informed on what’s happening. And when rates hit your target, they’ll be the first to let you know.

Bottom Line

If you’ve put your plans to move on hold because of where mortgage rates are, think about the number you want to see rates hit that would make you ready to re-enter the market.