The greatest appreciation in the DC area took place in five zip codes, two in DC and three in Northern Virginia. In addition, the DC area median price nearly hit the peak established in May 2023. All in all, don’t you wish you had bought your dream home five years ago?

Greatest Appreciation in Five Zip Codes

The areas around DC that have seen the highest home price appreciation in 2024 (so far) will probably make you wish you had bought a house here five years ago!

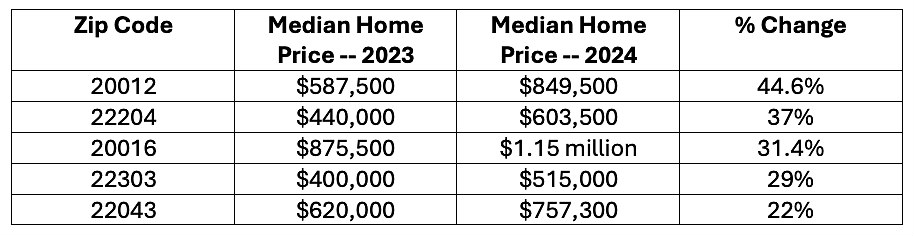

Here are the five zip codes that have seen the largest percentage increase in home values this year. In order to qualify for the list, a zip code had to record at least 30 sales in 2024.

The DC zip code of 20012, which encompasses Takoma, Colonial Village and Shepherd Park, has seen home prices rise nearly 45%, the result of every property type seeing price increases, particularly larger detached houses.

Greatest Appreciation in the DC Area Was in 20012

Where was the Rest of the Big Appreciation?

The South Arlington zip code of 22204 came in second, followed by the DC zip code of 20016 — home to AU Park and Spring Valley — where larger homes pushed prices up over 30%.

Rounding out the list are two zip codes where prices have risen 22%-29%. Those areas include the 22303 Alexandria zip code and the Falls Church zip code of 22403.

A similarity for almost all these zip codes is a lack of homes for sale. With the exception of the 20012 zip code, all the areas have less than a two-month supply of homes for sale.

Sale Prices Throughout the DMV

DC-area home prices approached record highs in March as more homes trickled on the market.

The latest report from Bright MLS found that the median home price in the region in March rose to $599,500, a 10% increase compared to last March. The price point is just $5,000 shy of the record set in May 2023. Home prices saw some of the biggest gains in Fairfax, Montgomery County and Arlington County.

Along with prices, the supply of homes for sale also rose, ending March up 4%, but that number is not necessarily an indication that supply is bouncing back. New listings, despite dropping 11% year-over-year, outpaced pending sales in March, so inventory ticked up.

“The spring will be challenging for buyers as new listings have been slow to come to the Washington, D.C. metro area market and mortgage rates remain elevated,” the Bright report stated. “Buyers who wait for lower mortgage rates later this year could find more inventory, but they will also face even more competition as rate drops entice more buyers into the market.”

What are You Waiting For?

If you have been sitting on the sidelines waiting for interest rates to come down, that may not be a recipe for success. When interest rates doubled in the second half of 2022, activity in the regional housing market slowed significantly. However, a drop in rates in January and February 2023 spurred a notable uptick in activity.

“As mortgage rates went above 7% in November, many buyers decided to hold off on their home search,” Bright MLS chief economist Lisa Sturtevant told UrbanTurf. As rates fell for five weeks in a row in early 2023, some buyers who were on the sidelines have returned. Pending contracts on homes in the DC region were up 24% in January compared to December, and showings also increased.

If you want to buy your dream home – or your starter home or condo, then we should definitely talk. While you are waiting for a better interest rate, prices are still going up. This may not be the year to buy your dream home, but perhaps it is the year to buy your investment property that you can live in for a few years and then convert to a rental. Let’s talk! You can reach Lise at 240-401-5577 or by email at lise@lisehowe.com.