Many economists see a recession coming in the next 12 months. What does a recession mean to your home buying plans? Should you delay? Should you go ahead?

Should You Delay Your Home Buying Plans?

According to a recent survey from the Wall Street Journal, the percentage of economists who believe we’ll see a recession in the next 12 months is growing. When surveyed in July 2021, only 12% of economists consulted thought there’d be a recession by now. But this July, when polled, 49% believe we will see a recession in the coming 12 months.

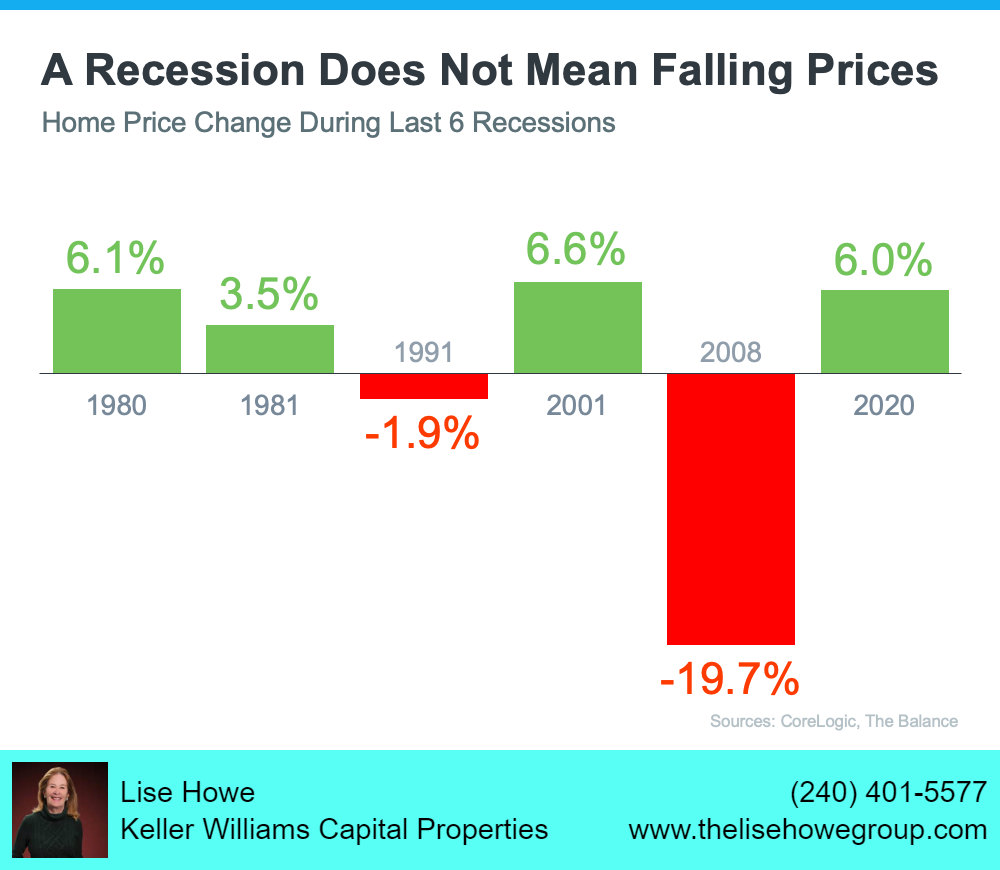

And as more recession talk fills the air, one concern many people have is: should I delay my homeownership plans if there’s a recession? Rather than worry in a vacuum, it helps to look at the past performance of the housing market in the last six recessions. Remember, most recessions were caused by factors other than the housing market. Only the one in 2008 was due to the housing bubble.

How Do Housing Markets React?

A Recession Doesn’t Mean Falling Home Prices

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph below) and assume another recession will repeat what happened then. But this housing market is not like 2008 and very very few people expect this market to crash. The market is very different today than it was in 2008. So, don’t assume we’re heading down the same path. It is helpful though to look at what the historical trends have been in past recessions.

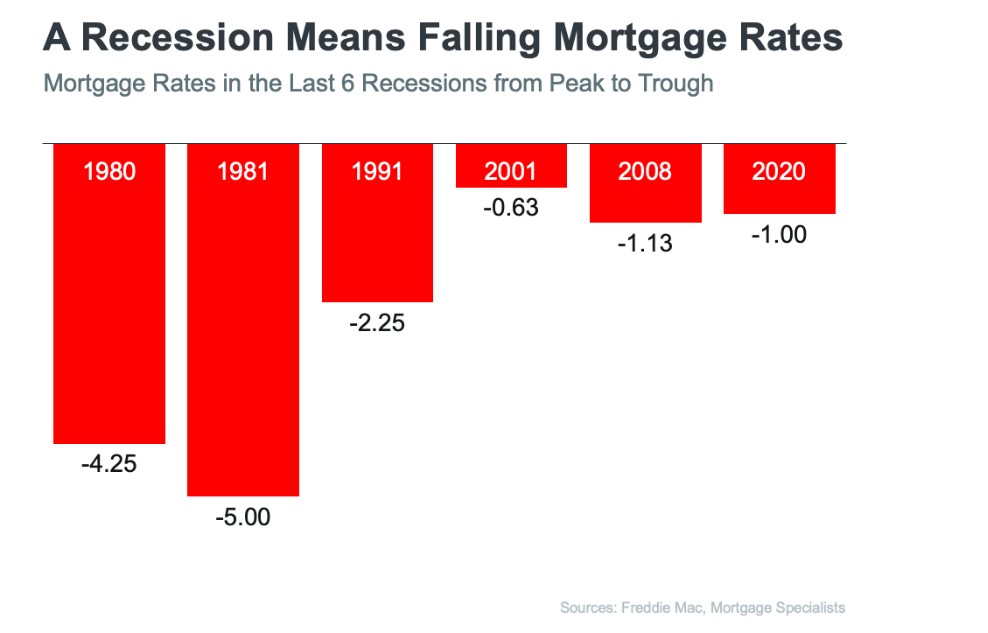

Interest Rates Typically Come Down

Interest rates are now controlled to at least some extent by the Federal Reserve. Interest rates are up dramatically now because the Fed has raised rates to control the current high rate of inflation. In a recession, the Fed reduces interest rates to stimulate the economy and get us out of a recession. When the Fed tries to stimulate the economy and reduces interest rates obviously the mortgage industry and buyers benefit from that reduction.

According to Fortune Magazine, interest rates typically fall during a recession.

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

Historically Recessions Aren’t Bad News for Real Estate

There’s no doubt everyone remembers what happened in the housing market in 2008. But you don’t need to fear the word recession if you’re planning to buy or sell a home. According to historical data, in most recessions, home price gains have stayed strong, and mortgage rates have declined.

If you’re thinking about buying or selling a home, let’s connect so you have expert advice on what’s happening in the housing market and what that means for your homeownership goals. You can reach me at Lise@lisehowe.com or 240-401-5577. If you are ready to start looking right now, just click here.