The first question that most buyers ask is “How much money do I need to buy a house?”

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

Simply stated, it depends on the financing program you are going to use, your credit score, and sometimes, the condition of the house. Whatever your financial situation, there is probably a financing program for you.

HOW MUCH MONEY DO I NEED TO BUY A HOUSE?

Buying a home requires cash for the down payment and closing costs. It also requires money for the

inspections and moving into the house. It is more cash to close than just a down payment. It’s hard enough to save for the down payment on your home and then you find out that you need more—often a lot more—in order to close the sale. UGH! But don’t despair. It is possible to get a financing program with little or no money down, and you can ask the seller to cover your closing costs. You can shop around for home inspectors, and maybe your friends will help you move in.

The actual down payment

Remember that there are options for your down payment besides 20%. If you are financing with FHA, VA or a USDA loan, you will not be required to put down 20%. Even if you get conventional financing, you can avoid putting 20% down by paying additional private mortgage insurance (PMI). Many mortgage lenders have options with down payments of 10 percent, 5 percent or even 3 percent. Obviously, this is a good reason to shop around for the mortgage lenders. Not every lender has the same options!

Closing Costs – on Top of the Down Payment

The cash outlay at settlement is frequently much higher than just the down payment. Closing costs may be two to three percent of your loan amount. For example, on a $200,000 mortgage, you will pay as much as $4,000 and $6,000 in addition to your down payment.

There are no set guidelines for how much closing costs will be. Closing costs vary from one state to another. This is due to different rates for the real estate transfer tax, or mortgage “stamps” (government taxes collected based on a percentage of your mortgage loan amount). Closing costs can also vary because appraisals, attorneys, and even title insurance have different costs from state to state.

Closing costs can also vary from one lender to another, and even from one loan to another. For example, each lender charges a different application fee. In addition, lenders often charge “points”—so named because they represent a percentage point of the loan amount.

An origination fee is an example of a point. It is compensation to the lender for placing the loan. Discount points are another type. They represent points paid to lower the mortgage interest rate on a permanent basis.

Two Alternatives to Eliminate or Reduce Closing Costs

There are actually two alternatives that can either reduce or completely eliminate closing costs:

You can ask the seller to pay your closing costs. This is common practice in the DC Metro area – although it may require that you increase your offering price to cover your closing costs. In that case, you should be careful to have a contingency in the contract that if the house does not appraise for the sale price, you can void the contract or renegotiate the sale price downward.

Alternatively, you can negotiate premium pricing with your lender. In this case, you will pay a higher interest rate on your mortgage in exchange for the lender paying the closing costs.

Either may be a good option, particularly if you are making a minimum down payment, like five percent, and adding closing costs on top would make your cash outlay significantly higher.

Prepaid expenses – on top of closing costs AND your down payment

These can be the most confusing charges for home buyers, but they are generally unavoidable. In

most instances, the lender collect 1/12 of your real estate taxes and homeowner’s insurance each month and put them in escrow. This means that your monthly payment will cover your principal and interest payments and your taxes and insurance. Your lender collects the taxes and insurances each month in an escrow account and pays them when due.

In order for that to happen, the lender needs to collect certain amounts at closing to ensure that the necessary funds are available to make the payments when they are due. The escrow accounts are set up to pay the charges on the next due date, while a portion of your monthly payment replenishes the escrow account for the due date after that.

Depending on where you live, and the frequency of real estate tax collections, the lender may have to put anywhere between two and 12 months of real estate taxes in escrow. If the taxes on the house are $250 per month, and a six-month escrow is required, that will translate to a prepaid expense of $1,500 at closing.

Insurance payments are treated in the same way. Typically a buyer prepays a one-year homeowners insurance policy on their new house, plus an extra two months of premium charges to the lender’s escrow account. Fortunately, insurance is not terribly expensive by itself. The lender may also escrow one or two months of premiums for PMI as well, if required.

Fortunately, you can have some or all of the prepaid expenses paid for you by either the seller, or by premium pricing paid to the lender. A third option is to decline the escrow arrangement by the lender. This will require that you make a down payment of at least 20 percent.

Still another expense that could require adjustment at closing are homeowners association or condo fees. In many homeowners association neighborhoods, member fees are paid on an annual basis. Condo fees are typically paid on a monthly basis. If the seller has paid the home owner fee for the full year, and you’re closing on the house on March 31—three months into the year—you will be required to reimburse the seller for nine months’ worth of fees. There may also be a fee to the HOA to get started. Basically, it’s a lump sum upfront from the new homeowner to get into the HOA and can run $100 or more.

Since these adjustments are direct expenses, they generally cannot be paid by the seller, since doing so could constitute an inducement to complete the transaction.

Lender-required “cash reserves”

This one can be a real surprise. Lenders require that you have so much cash left in savings after all closing costs are paid. Lenders want to avoid a buyer “closing broke”. They don’t want you to end up in an early-term default. The requirement that you have some cash in reserve ensures that the borrower will be able to make their payment during the first few months.

The most typical cash reserve requirement is two months. That means that you must have sufficient reserves to cover your first two months of mortgage payments. So if your principal, interest, taxes, and insurance (PITI) come to $1,500 per month, the reserve requirement will be $3,000.

These are not funds that must be deposited with the lender. But the lender must be able to verify that you will have the funds available in a liquid source. These include savings account, checking account, or money market fund—after closing on the property. Generally speaking, they frown on using retirement assets for this purpose, since those funds cannot be easily liquidated

HOW MUCH MONEY DO I NEED TO BUY A HOUSE IN SAVINGS?

How much do you need to save to buy a house? The amount you need will depend on several factors (mostly the size of your down payment). You’ll need sufficient funds for the following items:

- Down payment

- Closing costs

- Cash reserves

- Moving expenses

Let’s talk about each of these items in turn:

Your down payment is the biggest factor of all. Depending on the type of loan you choose, you might have to make a down payment of zero to 3.5% to 20%. On a mortgage of $200,000, that would be the difference between $7,000 and $40,000, respectively. That’s obviously a broad spectrum. So the first thing you need to do is research the different types of mortgage loans, to determine what kind of down payment you might be facing. This will help you determine your down payment costs.

While the exact percentage of your down payment may vary, it will always be based on the size of your loan. So the more house you buy, the larger your down payment will be. So, when determining how much of a house you can afford, you need to consider two things: (1) the size of your monthly payments, and (2) the size of your down payment. Both of these things are necessary when establishing your housing budget. They will also help you figure out how much money you need to save to buy a house.

If you qualify for a VA or USDA loan, you might not have to make a down payment at all. But those loans are only offered to certain types of borrowers (military members and low-income rural families, respectively). Everyone else will incur a down-payment expense of some kind, so it’s important to save money for it early on in the home buying process.

If you put down less than 20% on the loan, you’ll probably have to pay for private mortgage insurance (PMI) as well. There are ways to avoid this cost, though. You just have to make sure that the loan-to-value ratio of any one mortgage does not exceed 80%. Some people use a first and second mortgage to “sidestep” PMI. For example, the first mortgage accounts for 80% of the house price. The second loan covers 10% of the cost. And the home buyer pays the remaining 10% as a down payment. This is referred to as an 80-10-10 piggyback loan, by the way. But I digress…

Regardless of your financing strategy, you’ll have to save up enough money for a down payment of some kind. So plan early, and save as much as you can. More is better.

You’ll also need enough money to cover your closing costs, which are due on closing day (hence the name). These are the various fees and charges you rack up during the mortgage process. Basically, anytime somebody touches a piece of paper or performs an administrative task, you’ll have to pay for it. The seller might chip in to cover some of your costs — i.e., a seller’s concession — but you shouldn’t count on this. You should save enough money to cover them on your own, in case that’s what happens.

Closing costs usually range from 3% to 5% of the loan amount. So on a mortgage loan of $250,000 the closing costs could easily exceed $10,000. When you save money to buy a house, you need to factor in the closing costs.

Your lender may also require you to have a certain amount of cash reserves during the home-buying process. This is money you have in the bank, above and beyond your down payment and closing costs. They want to make sure you have saved enough money for your first mortgage payment, or your first couple of payments. Some lenders have this requirement, while others don’t. And even among those that do require cash reserves, the reserve requirement can vary from 1 to 6 months worth of mortgage payments in the bank! So be sure to get offers from more than one lender. Learn more about cash reserves.

And then you have your moving expenses. You also need to save up enough money for these, when you buy a house. This is separate from the mortgage approval process, but I want to at least mention it. Do you have to rent a Uhaul truck to move your furniture? Need to buy new furniture? Planning to hire movers? Be sure you save enough money to cover these costs as well. Many buyers focus solely on their mortgage-related costs, to the point they forget about their moving expenses. Then they have to beg, borrow and steal to tie up the loose ends. Nobody wants that.

WHAT IS A DOWN PAYMENT FOR?

It’s standard procedure to make a down payment on a home at closing, and lenders have a good reason for wanting you to make one.

Security for the lender

A down payment provides security for the lender. If you put a significant amount of your own money into a home, you are less likely to walk away and default on the loan. Lenders, understandably, want to make sure that they’ll be repaid; your down payment provides that reassurance.

Easier loan approval for you

Another reason for lenders wanting a down payment involves loan approval. Your down payment makes it easier for you to qualify, and the more money you put down, typically, the easier it is for you to be approved. Though it may be possible now to obtain a loan with no down payment whatsoever, qualifying for a loan is a lot easier if you’re able to make a down payment.

Building your equity

When you make a down payment on a home, you’re building equity (the percentage of the property you actually own). And the more you put down, the greater your equity. The more equity you have, the less you need to finance and the less overall interest you will need to pay on your loan. A down payment therefore benefits not only the lender, but you as well.

HOW MUCH DOES A FIRST TIME HOME BUYER HAVE TO PUT DOWN?

It really depends on which programs are available to you. This is a conversation that you should have with several lenders since not all lenders offer local housing programs. There may be first time home buyer programs in your community that require that you take a course to learn about home ownership. These programs get a first time home buyer into a home with very little money down.

For instance, a new initiative in Montgomery County, Md., in spring 2017 provided up to $40,000 for home buyers in the form of a zero-interest loan for down payment or closing cost assistance. The program, offered in partnership with the Maryland Department of Housing and Community Development through the Maryland Mortgage Program, was to run through Dec. 31 or until all funds are spent. Although the funds quickly were expended, hopefully this program will be renewed. Washington DC offers the Open Doors program, which provides similar assistance for home buyers.

Other programs which reduce the amount of money needed for a down payment include FHA, VA and the USDA loans. Don’t believe you have to have 20% for a down payment!

WHAT IS A GOOD DOWN PAYMENT ON A HOME?

Twenty percent is still the preferred number – or even higher! Lenders love buyers with good credit and big down payments!

Wait! What if you don’t have the ideal full 20% down payment? You’ve got options.

- Option 1 is to see about a gift from a relative or friend to help you get to that magic 20% down payment amount. Asking loved ones for money can be tough but if you explain that putting more money down will save you thousands in interest payments over the life of the mortgage, you might get the help you need. You can show them the results of a mortgage down payment calculator like ours to help make your case.

- Option 2 is to put less than 20% down to secure a first mortgage on the home itself and use a second loan to finance the difference between your contribution and the 20% mark. This second loan is known as a piggyback loan and will typically come with a higher interest rate than the first loan. Piggyback loans went out of fashion during the financial crisis but they’ve since made a comeback. With a piggyback loan, you’ll be asked to put 5%, 10% or 15% down for a first mortgage that covers 80% of the home value. Then your second loan, the piggyback, will finance the difference between what you have and the 20% target. So if you only have 5% to put down, you’ll be looking at what’s called an 80/15/5 loan. Your first mortgage will cover 80% of the home value, your second mortgage will cover 15%, and you’ll be on the hook for that last 5% as a downpayment. If you have 15% of the home value to put down, you’ll need an 80/5/15 loan. You get the picture.

- Option 3 is what’s called private mortgage insurance (PMI) and it’s a common route for first-time homebuyers. If you’re putting less than 20% of the home value down, your lender will want to insure your mortgage in case you run into trouble keeping up with the payments. Many private insurance companies offer this kind of mortgage insurance. As the buyer, you will be on the hook for the insurance premium but the lender will be the beneficiary should you fail to make your mortgage payments. How much will those premiums run you? Insurance companies generally charge between 0.3% and 1.15% of the loan amount annually.

- Option 4 is to see if you qualify for a loan backed by the Federal Housing Administration. SmartAsset can help you determine whether or not you qualify for an FHA-approved loan as well as you whether or not you qualify for an FHA-approved loan, and what’s the maximum home value you could finance with an FHA loan in your target area.

- Option 5 is to apply for a Wealth Building Home Loan (WBHL). This a relatively new program designed to help low-income Americans build home equity faster than they would with a traditional 30-year loan. With a WBHL you can use any savings you have to buy points that will reduce your mortgage interest rate. Depending on how much money you can put toward buying points, your interest rate could go as low as a fraction of a percent. That means that your monthly payments will be going almost entirely to equity, not to the bank. You’re essentially paying yourself to invest in your home.

- Option 6 is to seek a USDA home loan—if your home is in a rural area as defined by USDA. The Department of Agriculture backs mortgages that require little or no money down to applicants in designated rural areas and whose incomes are 115% or less of the median income in that area.

- Option 7 is to check out down payment assistance opportunities through your state government. Many states offer interest-free loans to low- and moderate-income first-time homebuyers. These loans can be applied to down payments or to closing costs.

CAN I BUY A HOME WITH NO DOWN PAYMENT?

Yes! There are programs such as VA loans which allow you to purchase a home with no money down. You need to discuss with several lenders which program may be the best fit for you. Do your homework! Home ownership is a possibility!

WHAT CREDIT SCORE IS REQUIRED TO BUY A HOME?

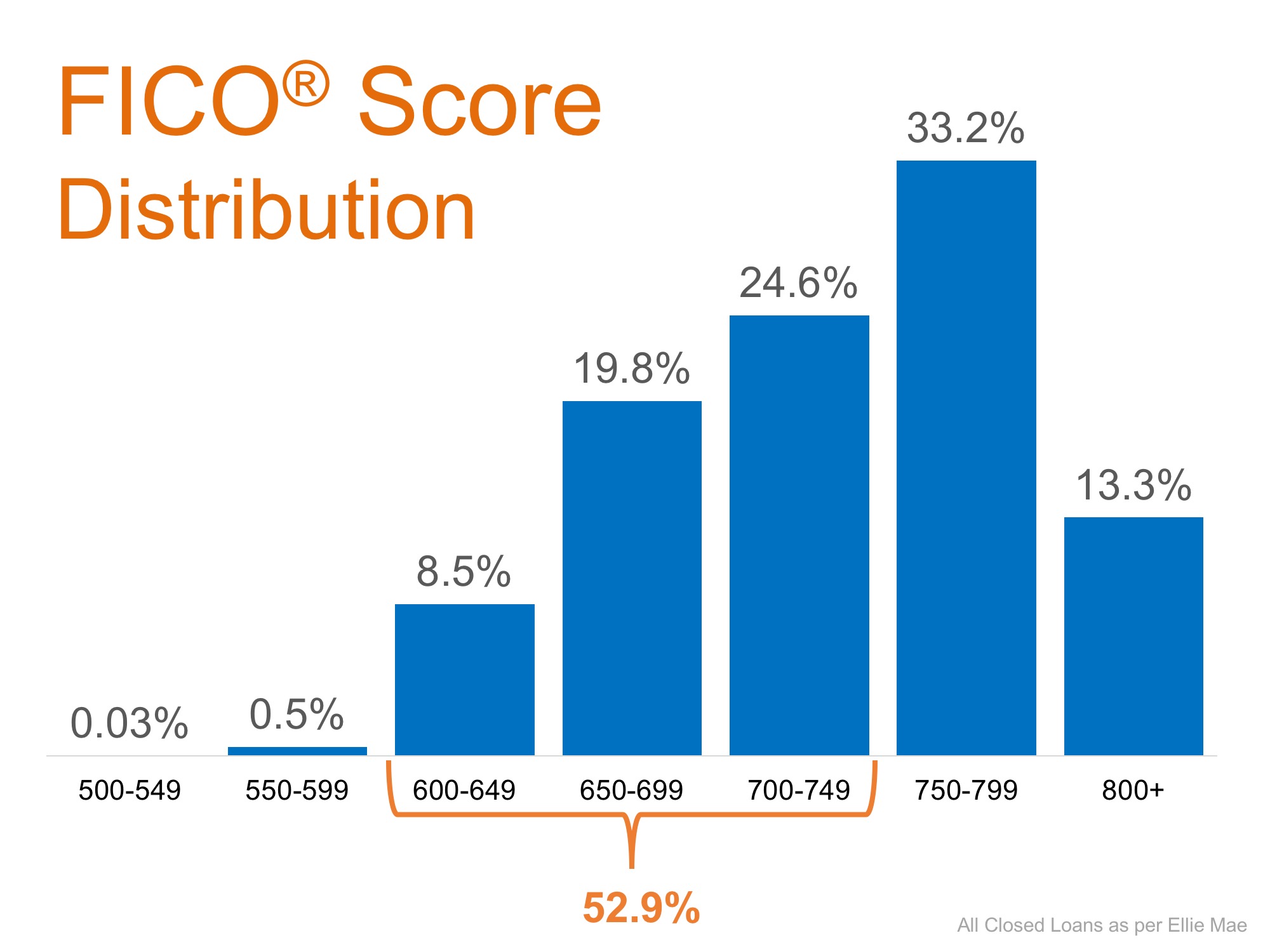

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August 2017 had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

WHAT ARE ALL THE COSTS IN BUYING?

Earnest Money Deposit

When you ask, “How much money do I need to buy a house?” you need to calculate how much the earnest money deposit is going to be. After making an offer and coming to an agreement with the home seller, a buyer is generally expected to pay 1 to 3 percent of the purchase price immediately. This earnest money deposit is held until closing, when it becomes part of the down payment. If the buyer backs out of the deal unexpectedly, the seller keeps the money. If the deal falls through due to a contingency that was previously laid out, the buyer would get the money back. On a $425,000 home, the earnest money deposit would be between $4,250 and $12,750.

Home Inspection

The next outlay is generally the home inspection, which costs in the neighborhood of $300 to $600.

Down Payment

Your down payment will likely vary from zero for a VA loan to 3.5 percent of the purchase price, with an FHA-backed loan, to 20 percent. So, for a $425,000 home, you would need to put between $14,875 (3.5 percent) and $85,000 (20 percent) down. Down payments of greater than 20 percent are also an option and would lead, of course, to smaller mortgage payments and most likely, a lower interest rate.

Closing Costs

Closing costs typically range from 2 to 5 percent of the purchase price. Included in the sum are title insurance, loan-processing costs, taxes, and various other fees (a rundown of the average closing costs in DC can be found here). These costs are sometimes negotiable; in certain markets, an eager developer may defer closing costs.

For our $425,000 example, closing costs would range from $8,500 to $21,250.

Homeowner’s Insurance and Moving Costs

Every mortgage needs to be insured. The first annual premium is usually paid at closing. Be sure to also keep some cash on hand for moving costs, which will vary based on how large a place you are moving from and how much stuff you have.

DON’T FORGET YOUR MONTHLY BUDGET

The information above explains how much money you might need to buy a house. In addition to planning for your up-front costs, you should also create a budget for your monthly mortgage payments.

This is where many home buyers go astray. They put too much trust in their lenders, in terms of affordability. They figure the lender will only approve them for an amount they can afford. But that’s not always the case. So make sure you have a firm number in mind, as to what you can afford each month. And do not exceed that number.

HOW MUCH MONEY DO I NEED TO BUY A HOME UNDER THE MARYLAND MORTGAGE PROGRAM?

The Maryland Mortgage Program provides help in the form of Down Payment Assistance, as well as a range of Partner Match programs from employers, developers and community organizations that can help you cover these down payment and closing costs. These programs may make it possible for first-time home buyers to afford a mortgage when they would not be able to do so the conventional way.

Down Payment Assistance and Partner Match Programs may be used for things like down payment, closing costs, and prepaid/escrow expenses, and may be available in the form of zero-interest deferred loans, forgivable loans, or outright cash grants:

- Zero-interest deferred loans are due upon sale or transfer of the property or if the first mortgage is refinanced or paid in full, and do not accrue interest over time (if you borrow $5,000 now to help with your down payment, you would repay $5,000 when due – perhaps as far away as 30 years if that is how long you are making payments on the primary mortgage);

- Forgivable loans are (in most cases) loans that diminish over time, based on you continuing to make payments on your primary mortgage and staying in your home for a pre-determined period. In a typical case, a loan of $2,500 would drop $500 each year for five years, so that if you lived in your home for this period, you would not have to pay it back at all. However, if you had decided to move after 2 years, you would be required to pay back $1,500 (the original $2,500 loan less $500 for each year you stayed).

- A cash grant is provided by some Partner Organizations, and does not require you to ever pay back the money.

Maryland Mortgage Program’s Down Payment Assistance Program

The Maryland Mortgage Program features Down Payment Assistance, which is an additional loan available to anyone who is eligible for a Maryland Mortgage Program mortgage, helps borrowers put together a suitable down payment on their home. This loan, which can be up to $5,000, is a zero percent deferred loan, which means that you only ever pay back the principal (there’s no interest) after you complete all payments on the main Maryland Mortgage Program mortgage, or if you refinance, sell or otherwise vacate the home.

Partner Match Programs

The Department of Housing and Community Development has partnered with a range of organizations that can provide you with additional funds (sometimes grants, sometimes loans) to help you purchase your first home, and which will be matched by the Maryland Mortgage Program up to $3,500 (as a zero-interest deferred loan – some conditions may apply). These partner organizations include:

Typically, contributions from these organizations range from $1,000 to $5,000 each, and may be combined with each other and with the Department of Housing and Community Development’s Down Payment Assistance loans where eligibility requirements are met. Many borrowers are able to take advantage of at least one of these programs. Go to Maryland’s Partner Directory to search for participating organizations.

Special Information for State of Maryland Employees

Further Assistance from Local Governments

In addition to the Department’s Down Payment Assistance and Partner Match programs, many local governments throughout Maryland offer additional support to purchase a home in their community. These local governments often work with employers and community organizations to provide local partner assistance beyond state programs already described above. This assistance can be combined with the Department’s Down Payment Assistance and Partner Match Programs to help you with upfront homeownership costs.

Check with your local city or county housing agency for more information, or ask your Lender to help you identify what assistance may be available to you.